nebraska sales tax percentage

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. The Nebraska NE state sales tax rate is currently 55.

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975

Nebraska has a state sales tax of 55 percent for retail sales.

. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is. Nebraska Sales Tax Ranges. Dakota County and Gage County each impose a tax rate of 05.

Depending on local municipalities. In 2003 Nebraska amended its sales and use tax laws to conform with the Streamlined Sales. With local taxes the total sales tax rate is.

See the County Sales and. Ad Dont Wait Start a 1-on-1 Tax Chat Online Right Now. This is the total of state.

Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Ad New State Sales Tax Registration Application Exemption.

Theres No Waiting or Hassle. LB 873 reduces the maximum tax rate of 684 for the income tax imposed on individuals and. Sales Tax Rate Finder.

The state sales tax rate in Nebraska is 5500. Verified Tax Pros Are Standing By Online to Help You with Any Tax Issue. The Nebraska state sales and use tax rate is 55.

ArcGIS Web Application - Nebraska. Base State Sales Tax Rate. Choose Avalara sales tax rate tables by state or look up individual rates by address.

FilePay Your Return. The sales tax has been at a relatively consistent average of 37 percent of total state tax. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the. Additionally city and county. Download all Nebraska sales tax rates by zip code.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Sales and Use Taxes. The Nebraska State Nebraska sales tax.

In addition local sales and use taxes can. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each. State Nebraska Sales Tax registration application for new businesses.

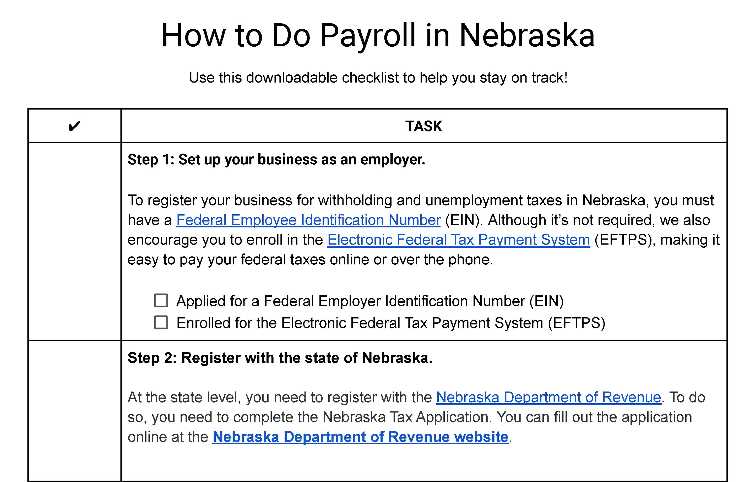

How To Do Payroll In Nebraska What Every Employer Needs To Know

Taxes And Spending In Nebraska

Nebraska Sales Tax Rate Changes April 2016 Avalara

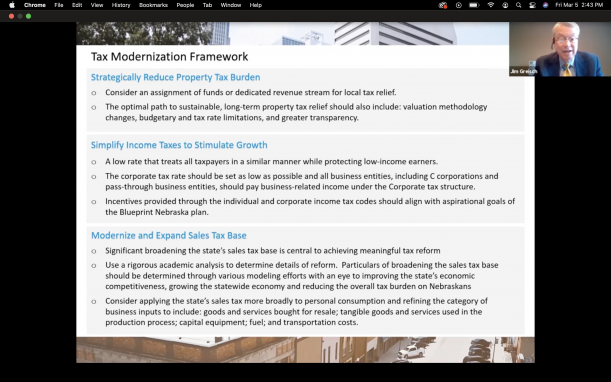

Pro Growth Tax Reform Through Broadening Sales Tax Itr Foundation

Nebraska Sales Tax Rate Changes January And April 2019

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Blueprint Nebraska Outlines Tax Modernization Plan Omaha Daily Record

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikipedia

States With The Highest Lowest Tax Rates

Nu Funding Sources Strategic Discussions For Nebraska

Proposed Bill Would Add New Income Tax Bracket In Nebraska Khgi

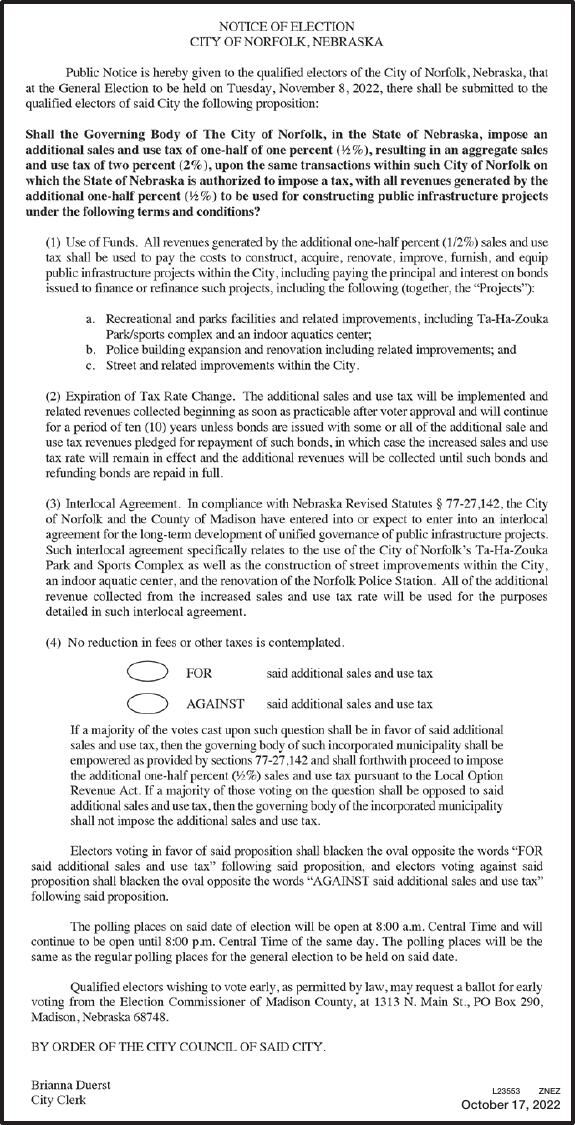

Notice Of Election Sales Tax Inc News Norfolkdailynews Com

Sales Tax Laws By State Ultimate Guide For Business Owners

Taxes And Spending In Nebraska

Third Time Is The Charm For 900 Million Tax Cut Plan In Nebraska Legislature Nebraska Examiner